franchise tax bd co

Franchise Tax Bd 4 Cal3d 1 5-6 92 CalRptr. Gas Co etc Cal.

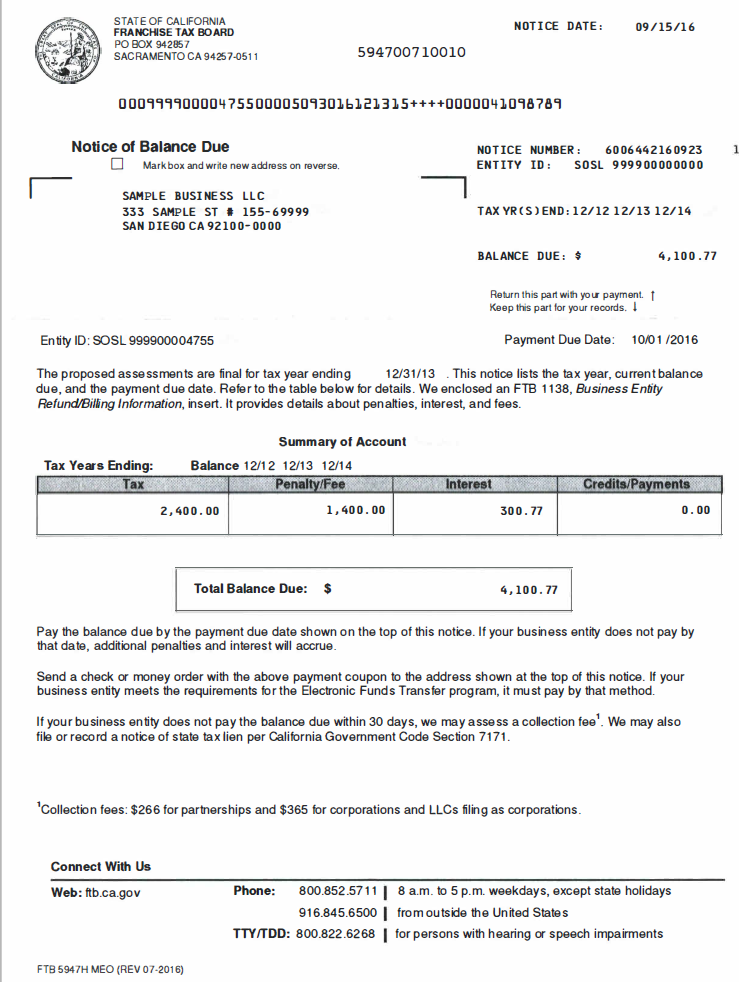

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund.

. Petitioner Franchise Tax Board of California Board the state agency responsible for assessing personal income tax suspected that Hyatts move was a sham. CaseIQ TM AI Recommendations FRANCHISE TAX BD. A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax.

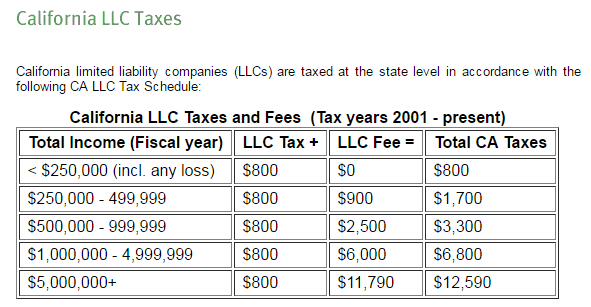

For LLCs the franchise tax is 800. In 1993 the Legislature adopted a different apportionment formula by amending the Revenue and Taxation Code to provide that notwithstanding the. ISSUE Whether in a series of differing situations pass-through entity holding companies are unitary with.

See also Pacific Gas Electric Co. Franchise Tax Board 1963 60 Cal2d 417 425 34 CalRptr. THE GILLETTE COMPANY et al Plaintiffs and Appellants S206587 v.

In California the franchise tax rate for S corporations is the greater of either 800 or 15 of the corporations net income. INTERNATIONAL DOUBLE TAXATION world have adopted the ALISA method16 ALJSA treats each corporation as an independent entity dealing at arms length with its affiliates1 7 The internal accounting records of the corporation determine the income attributable to that. LEGAL RULING 2021-01 SUBJECT.

Franchise Tax Bd 138 Cal. Just checked my bank account and apparently on 9916 I had several hundred dollars deposited into my account. 3d 457 Brought to you by Free Law Project a non-profit dedicated to creating high quality open legal information.

Of Equalization 1994 22 CalApp4th 1194 1203 27 CalRptr2d 783 statutes governing administrative tax refund procedures backed as they are by a plenary constitutional authority are to be strictly enforced. I am a bot and this action was performed automatically. Please contact the moderators of this subreddit if you have any questions or concerns.

14 A130803 FRANCHISE TAX BOARD San Francisco County Defendant and Respondent. 159 77 LEd2d 545 103 SCt. Feb 11 1983 Feb 11 1983.

FRANCHISE-TAX-BO-PAYMENTS has been in the DB for a while it is the number 23352. W-4 IRS Withholding Calculator. IN THE SUPREME COURT OF CALIFORNIA.

Liberty has hundreds of employees and an office located. 2006 39 Cal4th 750 755-756 Microsoft For the taxable. 122 611 P.

The fact that the court has restricted the boards discretion to apply separate accounting rather than allocation under the unitary business rule see Superior Oil Co. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. 545 386 P2d 33.

504 Given that Castle executives made up the entire Hy-Alloy board of directors Castle was effectively able to control Hy-Alloy at least with respect to major policy. There are 7222 searches per month from people that come from terms like franchise tax bo or similar. In 1974 the state of California joined the Multistate Tax Compact which contained an apportionment formula and permitted a taxpayer election between the Compacts formula and any other formula provided by state law.

Unity of Apportioning Pass-through Entities. It comes from Panama. Did you take the Standard Deduction on your 2019 Federal return.

See Chase Brass Copper Co. I have a traffic ticket which I extended the court date 3 months later. 489 479 P2d 993 However subsection b deals specifically with the allowability of the interest deduction of corporations which allocate by formula.

FIRESTONE TIRE RUBBER CO Court of Appeal of California Second District Division Four. Subsequently in 1996 the Tax Board issued an. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so.

2933 in which the Supreme Court recently found a unitary enterprise to exist for purposes of California state tax law and the United States Constitution. To determine whether Hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency. Franchise Tax Board 1963 60 Cal2d 406 413 34 CalRptr.

139 CalApp3d 843 189 CalRptr. Opinion for Chase Brass Copper Co. Of Equalization 1980 27 Cal3d 277 284 165 CalRptr.

Franchise Tax Bd supra 10 CalApp3d at p. In 1993 the respondent State of California Franchise Tax Board hereinafter the Tax Board an independent California tax agency with a statutory duty to administer and enforce the California Tax Code see Cal Rev Tax Code 19501 commenced an audit of Hyatt with respect to his 1991 part-year resident income tax return. FIRESTONE TIRE RUBBER CO.

Whereas section 24425 deals with the allowability of deductions generally. Franchise Tax Bd 10 Cal. Chase Brass Copper Co.

FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. Liberty is a member of appellants combined reporting group and is the entity solely responsible for managing vendor relationships and negotiating vendor allowances. Great Western Financial Corp.

Technically I shouldnt have been guilty and I am fighting for it. FRANCHISE TAX BOARD Legal Division MS A260 PO Box 1720 Rancho Cordova CA 95741-1720. This also happened to me.

And Honolulu Oil Corp. Thus in 1993 the Board launched an audit. Of Equal Sept 14 1970 Unity or use is also present since appellant establishes overall policy for the business as evidenced by the fact that the partnerships managers are subject to dismissal for failure to follow appellants instructions.

502 Unity of use refers primarily to the integration and control of executive forces.

Getting A Phone Call From The Ftb Lsl Cpas

State Of California Real Estate Withholding Viva Escrow

California Franchise Tax Board Bank Levy How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

The Limits Of Nudging Why Can T California Get People To Take Free Money Planet Money Npr

Franchise Tax Board Homepage Tax Franchising California State

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento

California Ftb Rjs Law Tax Attorney San Diego

How To Pay Ca Franchise Tax Board Taxes Landmark Tax Group

California Franchise Tax Board Linkedin

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

What Is Franchise Tax Bd Casttaxrfd Solution Found

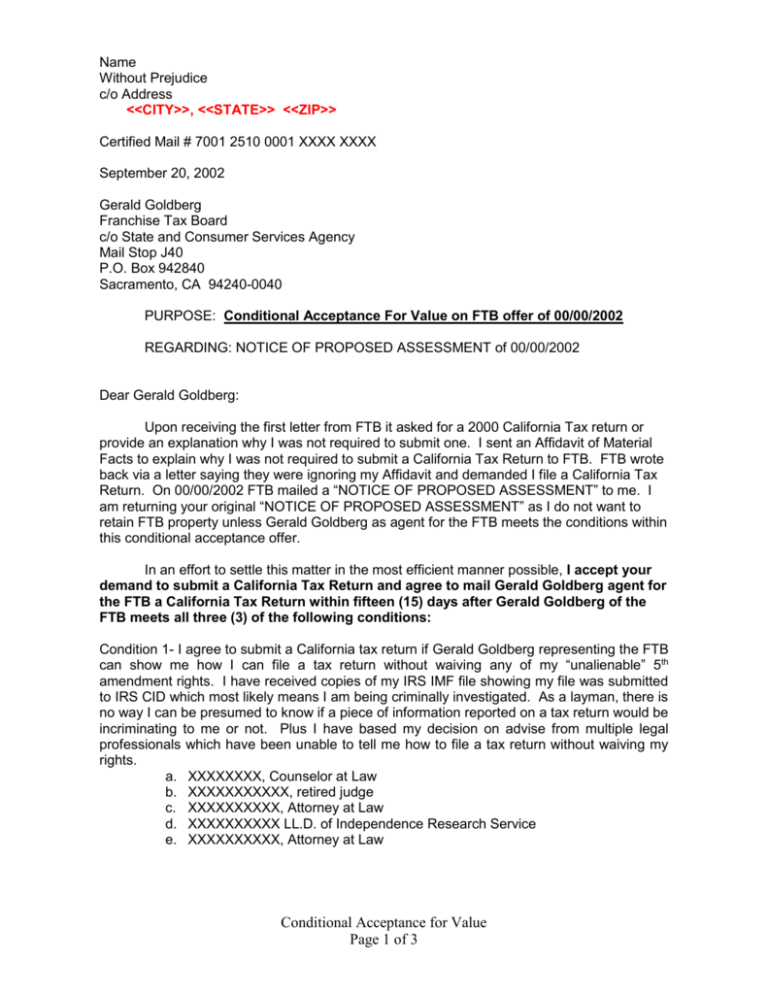

Conditional Acceptance Of Proposed Assessment

What Does Legal Order Debit Franchise Tax Board Mean Larson Tax Relief